The most beautiful Australian tax and pay calculator ever made - with ATO tables and formulas.

Tax calculations dont have to be complicated. Get a quick view of the bottom line so you can make important life decisions. Use the easiest 2019 Tax Calculator by Pocketbook to simplify your tax calculations for your 2019 Australian tax return. Also calculate your net income and superannuation through the year to make sure youve been paid correctly.

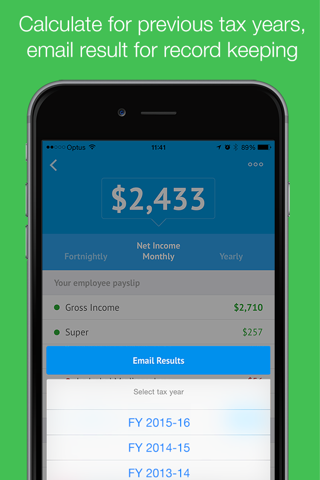

The Pocketbook Tax Calculator uses official ATO tax brackets, weekly, fortnightly and monthly withholding tables, formulas and common rules for the past 7 financial years. including:

- FY 2012-13

- FY 2013-14

- FY 2014-15

- FY 2015-16

- FY 2016-17

- FY 2017-18

- FY 2018-19

This simple and powerful tax calculator app complements our world famous budgeting app loved by over 700,000+ Australians. Also available on the Apple AppStore.

All our apps are made by Australians for Australian iPhone users.

Overview:

---------

Pocketbook Tax Calculator app makes complex tax calculations simple. Putting an end to manually setting up spreadsheets and looking up tax brackets, withholding tables, thresholds and deduction rules via the Australian Taxation Office website.

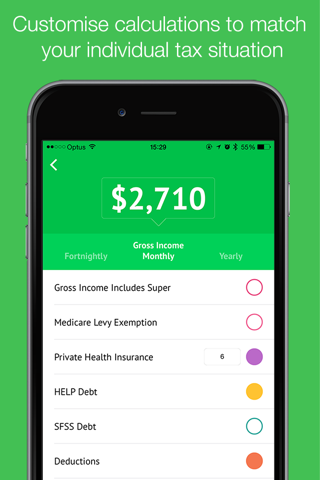

Super-fast calculations can be done in seconds and just enough customisation to tailor it to your individual tax situation. Whether you want to get ready for 2019 tax returns season, or just checking to see if your employer is paying you correctly.

Highlights:

----------

Reasons why the Pocketbook Tax Calculator is the best tool for quick tax calculations:

1. Simple conversion across weekly, fortnightly, monthly and yearly amounts - However youd like to express your income, weve got you covered. Simply swipe and get an annual view quickly.

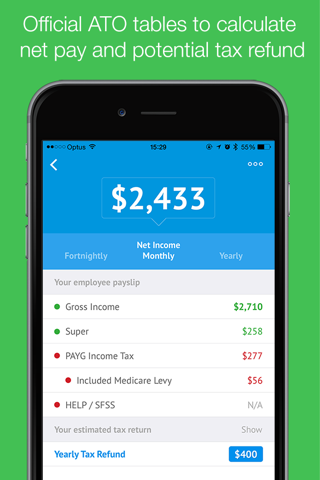

2. No more looking up tax brackets and tables - Weve built the ATO tax brackets, PAYG withholding tables, thresholds and rules in-app, so you no longer need to look things up and make sure your spreadsheet is calculating right.

3. Simple and clean interface - Weve brought our experience in building one of the best finance apps in Australia to tax. You can be assured this is the easiest to read and use.

4. All family situations factored in - Only tax calculator on the Australian AppStore to include calculations for Medicare levy, Medicare levy surcharge based on your individual family situations.

5. Indicative tax return refund - Based on official calculations of the difference between end of year tax bracket application and PAYG withholding payments, with consideration of any deductions, incomes and losses.

Features:

--------

Includes automatic consideration for:

- Income tax paid based on PAYG withholding tables for weekly, fortnightly and monthly

- Standard superannuation calculations for the past 5 financial years automatically applied

- Medicare levy and surcharge based on private health insurance arrangement

- Low-income tax credit

- Family considerations (spouse and dependents)

- HELP and SFSS

- Prompts for additional incomes, losses, benefits and deductions

- Includes FY 2012-13, FY 2013-14, FY 2014-15, FY 2015-16, FY 2016-17, FY 2017-2018, FY 2018-2019 tax years

Disclaimer:

While we ensure all calculations are extremely accurate and in line with ATO tables and brackets. Your specific situation may vary based on details this general app isnt able to capture. Please use these calculations as an indicator.

Visit https://getpocketbook.com/pocketbook-tax-calculator/ for more information.